Pricing AI Agents Strategically

How to monetize software that does work at human levels.

In 2011, Marc Andreessen famously proclaimed that “software is eating the world” as software companies began to outcompete traditional businesses across nearly every industry. These software companies scaled globally with high gross margins, fast iteration cycles, and dominant market positions. Andreessen argued that software businesses were positioned to capture massive economic value — not just because they delivered value to customers, but because they were uniquely capable of monetizing the value effectively.

Today, a new kind of software is emerging. AI agents are autonomous systems that don’t just assist humans, but actually execute work on their behalf. If traditional software ate the world by boosting human productivity, AI agents may do so by replacing it. At the same time, though, AI is nondeterministic and prone to errors. This raises an important question: how do you price software that can execute entire workflows, but sometimes doesn’t work?

AI companies like Decagon and Sierra are now experimenting with custom pricing models to reflect this shift. Among the most compelling is outcome-based pricing, where vendors charge customers only when a specific business result is achieved. This model stands in contrast to more familiar approaches like SaaS subscriptions or consumption-based pricing.

In this blog, I explain what each of these pricing models means for both agent vendors and customers. I compare their effects on revenue predictability, customer acquisition, incentive alignment, and profitability. My goal is to help AI vendors and customers evaluate the pricing model that’s best for them.

Software Pricing Models

Subscription Pricing

Since the early 2000s, the most prolific pricing strategy in software has been a subscription. This involves charging a fixed monthly or annual fee, typically per user or “seat.” In some cases, large enterprises will pay a single lump sum per period for an “enterprise tier” with unlimited seats.

The main benefits are predictability and simplicity. For customers, the cost of the software is known up front. The customer can easily stop using the software, and their costs will drop to zero the next period. With this set pricing, the customer is free to create as much value with the software as they can.

For example, a particularly productive consulting company could make use of their $200/user/month ChatGPT subscription to conduct unbounded amounts of market research and book more engagements. The consulting company would receive all of the surplus that comes from those engagements, making the ROI of the software potentially infinite.

The main downside for customers, though, is that the fixed fee poses a financial risk if the software ends up not providing any value. This is a source of friction for businesses considering adopting new software — unless they’re confident about the ROI, they can’t commit to the subscription.

For the vendor, the subscription model has pros and cons. On one hand, the vendor enjoys reliable recurring revenue regardless of the customer’s derived value. And, if the customer is on a per-user subscription, the vendor’s revenue can grow as more users at the customer’s organization start using the product. On the other hand, a vendor who sells an exceptional product to a productive customer does not share in the surplus created. Their only option is to try to renegotiate the subscription fee, hoping that the customer will agree given the value they’ve realized. Sure, OpenAI is happy to sell $200/month subscriptions, but if they hear that McKinsey is using ChatGPT to book an extra $1M in revenue, their reaction is likely going to be, “We should probably be charging more.”

Consumption-Based Pricing

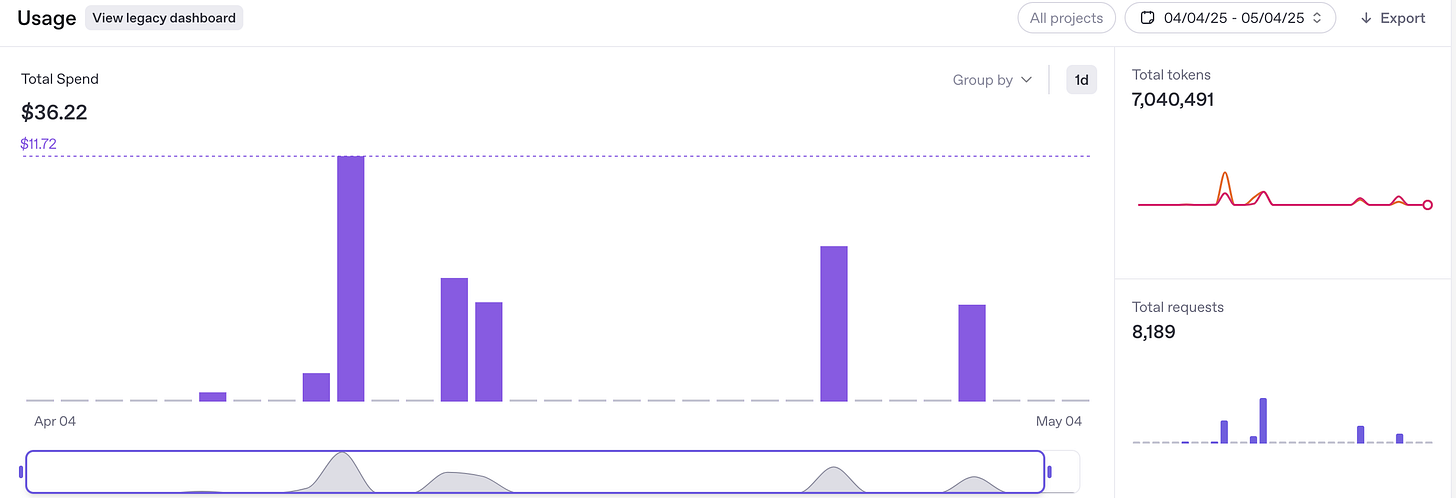

Another prevalent approach is consumption-based pricing. Popularized by cloud infrastructure providers like Amazon Web Services (AWS), this model charges customers according to their actual usage. So, payment scales with metrics like API calls, data processed, or compute hours. Foundation model providers like OpenAI and Anthropic use this model for their APIs, charging per token processed (Figure 1).

For customers, consumption-based pricing means only paying for what they actually use, thereby reducing wasted spend. This can lower the barrier to entry, since the up-front cost is 0. Crucially, though, payment is tied to resource consumption, not to the quality of results. Anthropic won’t refund an API call if the model failed to return a properly formatted tool call.

For the vendor, the main benefit is being able to scale revenue as the customer starts loving and using the product. In addition, profitability becomes very easy to track based on the contribution margin of an additional use. The downside is that revenue becomes unpredictable, since customer usage can fluctuate considerably. In addition, some customers might churn faster without the tether of a subscription.

Outcome-Based Pricing

Outcome-based pricing, also known as performance-based pricing, ties payment to achieved results or business outcomes rather than raw usage. If the desired outcome isn’t achieved, the customer is charged much less – or nothing at all.

Like consumption-based pricing, outcome-based pricing is variable. However, it better aligns incentives between the vendor and the customer — the vendor needs to accomplish the business outcomes that the customer desires, not just provide a tool for the customer to achieve those outcomes themselves.

This model is already prominent in other industries, such as consulting and advertising. Some consulting firms charge for gain-sharing or upside fees, where part of their compensation depends on achieving cost savings, revenue growth, or other agreed-upon outcomes. Similarly, in advertising, agencies often use performance-based contracts tied to metrics like customer acquisition, conversions, or ROI. For example, a digital ad agency might take a percentage of sales directly attributed to their campaigns.

Outcome-based pricing shifts business risk from the customer to the vendor. This benefits customers by making adoption less risky, but also forces them to give a cut of the gains to the vendor.

The most significant challenge with outcome-based pricing is reaching agreement on what counts as a payable result (e.g., “a support case is resolved to the customer’s satisfaction” or “a sale is closed”). This often leads to long and complex negotiations and post-facto debates on whether an outcome was truly successful, hampering the vendor’s scalability. To mitigate this, vendors establish standardized KPIs and SLAs that can apply to a wider range of customers and build tracking systems to measure their outcomes.

Comparing Pricing Models for AI Agents

The fact that agents can do work rather than just assist strengthens the case for vendors to charge based on what the agent directly accomplishes. Fixed per-seat subscriptions don’t accurately reflect the value of an agent that autonomously executes thousands of complex workflows for a customer.

Customer Risk and Adoption Speed

✅ Consumption-based pricing has low upfront risk; customers can start with minimal agent usage and scale spending as they please. If the consumption unit is simple, agent companies can avoid lengthy negotiations.

✅ Outcome-based pricing minimizes the customer's financial risk, ensuring that they won’t pay for incorrect outputs from the AI. But, each new customer would require negotiating KPIs and payment structures, making sales cycles longer than for consumption-based pricing.

🤔 A traditional SaaS subscription requires a larger upfront commitment, potentially slowing adoption. Customers, especially enterprises, will want to understand exactly what they are paying for, will try to estimate the number of seats they need, etc.

Overall, consumption-based pricing seems to offer the fastest adoption speed because of both low up-front risk for the customer and little required negotiation.

Revenue Predictability

✅ A SaaS subscription offers the most predictable revenue for the vendor, who knows in advance how much it will bill each period, assuming stable contract terms. This stability aids forecasting and is often favored by investors who desire recurring revenue.

⚠️ Consumption-based pricing, like Decagon's per-conversation model, is less predictable; it directly depends on usage fluctuations driven by customer activity or seasonality.

⚠️ Outcome-based pricing introduces the most variability. Revenue depends not just on the agent’s usage volume but also on its success in achieving defined outcomes. If the agent underperforms, if the definition of “success” is contested, or if the customer’s underlying business volume changes, the vendor’s revenue can suffer. To get around this, vendors who implement outcome-based models typically set minimum fees so that revenue at least has a lower bound.

Path to High Profits

✅ A SaaS subscription yields steady cash flow and high gross margins once the cost of serving an additional customer becomes negligible. Vendors face less short-term performance risk: even if the customer doesn’t fully utilize the product, they still pay the subscription fee.

✅ Consumption-based pricing means the vendor’s revenue directly fluctuates with usage; profitability is guaranteed as long as the contribution margin of each additional agent use is positive. Profitability can also grow if the vendor can reduce the marginal cost of agent use to zero.

✅ Outcome-based pricing shifts more delivery risk to the vendor. If outcomes aren’t achieved or volume is lower than expected, the vendor’s revenue could fail to cover costs.

For this reason, outcome-based pricing contracts are typically priced at a premium. The customer is getting a guarantee of success while the vendor is taking a bet on their own success.

If the vendor performs well, rewards can be substantial – they might capture a portion of the customer’s value creation that exceeds typical margins. For example, if an AI agent generates $1 million in revenue for a customer, a 5% outcome fee nets the vendor $50k – possibly more than they would have made on a flat subscription or usage-based model, yet the customer is happy because they only paid 20% of realized revenue.

Thus, profitability per successful outcome can be very high. The challenge is that the vendor’s earnings might be irregular and initially lower until success is proven. Vendors must manage cash flow or have capital to sustain this model, especially early on.

Framework: Deciding A Pricing Model

Companies should begin by analyzing their target customer profile. If customers prioritize minimizing upfront risk and demand guaranteed results, outcome-based pricing could work well, but companies should prepare for long negotiations over outcomes. If it is difficult to converge upon clear, measurable KPIs, companies should choose simpler SaaS or consumption models for faster deals and less disagreement in the engagement.

Next, companies should understand their own cost structures. If costs are dominated by variable costs linked to agent activity (e.g., compute or foundation model costs), consumption-based pricing is the best way to guarantee profitability because revenue will scale proportionally with costs. However, if the business model involves significant upfront investment or has low tolerance for revenue volatility, the financial stability of SaaS subscriptions might be the best.

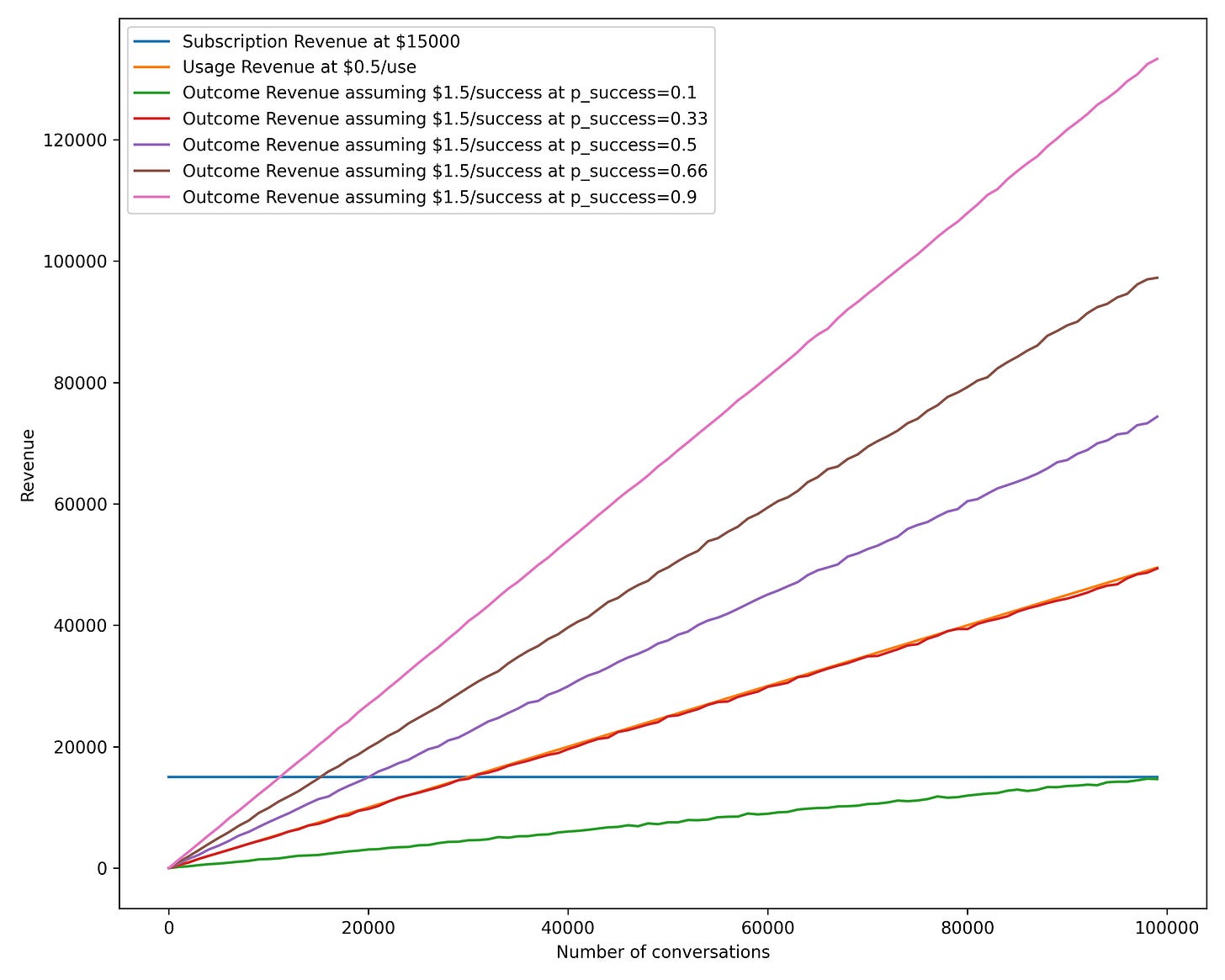

Importantly, companies should pursue outcome-based pricing only if they have high confidence in their agents’ performance and have the financial resilience to absorb potential revenue shortfalls. This relationship can be modeled by estimating the probability of a successful outcome, p_success, for each use of the agent. Consumption and outcome-based models lead to identical expected revenues if price_outcome × p_success = price_use. If companies are confident in their agent’s success rate, they can price outcomes at a premium above the threshold implied by the equation. However, if they overestimate the functionality of the agent, they can undershoot both subscription-based and consumption-based pricing revenues (Figure 2).

Lastly, the functionality of the agent itself should help inform the most logical model. For agents delivering easily quantifiable, high-impact business outcomes (e.g., direct revenue generation or cost reduction), outcome-based pricing is very feasible. For agents that assist with more general workflows where outcomes are difficult to measure, such as preparing slide decks, consumption or tiered SaaS models are more practical and scalable.

Final Thoughts

There’s no question that AI agents will create huge amounts of value in our economy. The pricing model used to capture that value is tremendously important. Different firms have begun experimenting with their own unique approaches, and pricing may soon become confusing for both vendors and customers. To succeed in the AI economy, businesses need to understand their needs and choose the pricing model that suits them best.

Acknowledgements

Thank you to Wharton Professor Z. John Zhang for his valuable feedback on this topic.

If you liked this post, subscribe and follow me on X and LinkedIn.